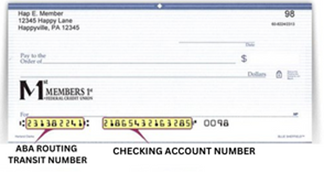

Our Routing Number: 231382241

Direct Deposit

Direct Deposit is the confidential, electronic transfer of your paycheck, Social Security benefit, pension, annuity check, or other payment into your savings or checking share product. Your entire paycheck can be automatically credited toward any combination of your Members 1st share products each pay period. Direct Deposit increases the safety and convenience of processing your check, eliminates waiting in payday lines, and makes your funds instantly available. With Direct Deposit, your money is protected.

- Sign in to Members 1st Online banking and choose the desired share product for your direct deposit.

- Navigate to the Actions section and choose Direct Deposit.

- Complete the remaining prompts and a PDF direct deposit form will auto populate with all the necessary details for your employer.

- Provide this completed form to your HR or Payroll Department to notify them of your direct deposit request.

Not enrolled in Members 1st Online banking? Utilize this blank Direct Deposit Form to complete your Direct Deposit setup.

Federal or state government employees: complete IRS Form 1099

- Our routing number/ABA number - 231382241

- Your 10- or 14-digit checking account number or your 17-digit savings account number.

- You can find this information by:

- Signing in to Members 1st Online banking and going to the "Accounts" page.

- Click the share product (checking, savings, loan, etc.) where you would like to receive the deposit.

- Your checking or savings account number and Member ID for direct deposit will be displayed at the top of the page.

- You can print an auto completed Direct Deposit form by:

- Sign in to Members 1st Online banking and going to the "Account" page.

- Click on the share product where you would like to receive the deposit.

- Navigate to the Actions section and click Direct Deposit.

- Complete the remaining prompts and a PDF direct deposit form will automatically populate with all the necessary details for your employer.

Your employer determines your start date based on its payroll processing criteria.

- When completing your Direct Deposit Request Form select checking or savings account.

- Complete a Payroll/Auto Transfer Distribution Form.

- You may setup automatic transfer via Members 1st Online which you can modify at anytime.

Automated Clearing House (ACH)

ACH transfers are another way to simplify your monthly bill paying. This is a convenient form of bill paying commonly used with utility and retail vendors such as your cell phone provider. Funds are electronically transferred from your account through the Automated Clearing House (ACH).

To set up automatic electronic payments, you need to contact your utility provider and/or retail vendor. Many times you can enroll in automatic payments directly from their specific web sites or you may have to complete a paper form.

Automatic payments may be made from your checking or savings account, depending upon your utility company or retail vendor.

It is really up to you. Our Checking Account offers overdraft protection to help you avoid bookkeeping errors.

Still have questions?

We're here to help you find answers. Give us a call or stop by your nearest branch.