How to Do a Month Long No-Spend Challenge

Minute Read

What is a No-Spend Challenge?

If you’re looking to save a little more so you can satisfy your needs, consider the no-spend month challenge. This is an exercise, typically a month long, that challenges you to only spend money on necessities. We’ve got the perfect way to help you track it.

How to Do a No-Spend Month Challenge

Create no-spend month rules for yourself including items you will and will not buy during this period. Think of these as your priority and off-limits expenses.

Examples of Priority/Necessary Expenses:

- Rent or mortgage payment

- Groceries

- Health and wellness

- Gasoline

- Utilities

Examples of Off Limits/Unnecessary Items:

- Clothing

- Beauty appointments

- Dining out

- Home décor

- Books and media

Keep in mind that your needs may vary for this no-buy challenge. While some people can go without spending money on things like Ubers or clothing, you may have a necessary circumstance where you need an Uber to get to work or a proper outfit for a job interview. Essentially, this challenge is yours to personalize—only you know your needs! Choose your categories and be diligent.

Planning Your No-Spend Challenge

Start with a 30-day trial of the No-Spend Challenge to help build a habit of saving more than you spend. This can show you when and where you can save more money in your everyday life. If possible, avoid starting the challenge during a month of special events, such as birthdays and holidays, that require spending money. Once you get into a routine, this can become a normal occurrence and make your life much easier.

Track Your Success

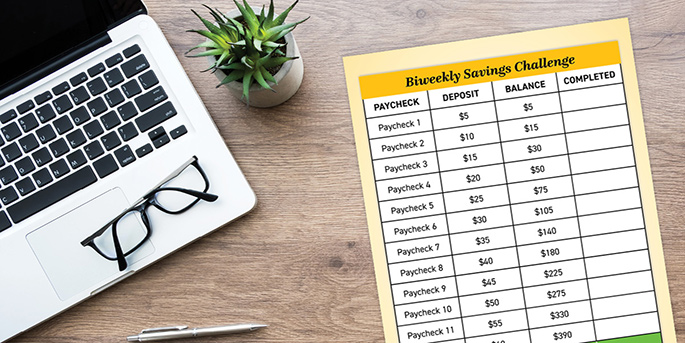

Download our printable No-Spend Challenge savings tracker to hold yourself accountable during your 30-day trial. Each day you don’t spend money, check off or color the piggy bank image on your tracker. At the end of the month, you will be able to see your progress!

The Benefits of a No-Spend Challenge

Participating in this challenge can take you from a spender to saver. Saving money in the unnecessary category means more of your income can go towards those items that you feel are necessary. Though it may seem challenging, your future self will thank you when it’s time for unexpected or large purchases. This will allow you to set clear goals, identify poor spending habits and save more money.

Need Help Staying on Track?

Consider opening a credit card to help you save during this process. A credit card featuring cash back and other rewards can help you save more without extra effort.